The United States releases the fifth batch of exclusion lists for taxed products worth billions

On June 8, 2020 local time in the United States, the Office of the United States Trade Representative (USTR) announced the product exclusion announcement for the fifth batch of US$300 billion in tariffs. Added 34 excluded products, including 8 categories of textile and clothing products (completely excluded). Excluded products will no longer be subject to a 7.5% tariff when exported to the United States. The excluded products listed in this announcement are valid from September 1, 2019 to September 1, 2020.

On August 20, 2019, the Office of the United States Trade Representative (USTR) decided to impose a 10% tax on Chinese goods with an annual trade volume of approximately US$300 billion. Additional tariffs on products listed in Action List A take effect on September 1, 2019. On August 30, 2019, USTR decided to increase the surtax rate from 10% to 15%. On January 22, 2020, USTR decided to reduce the tax rate from 15% to 7.5%. List B has not yet been launched.

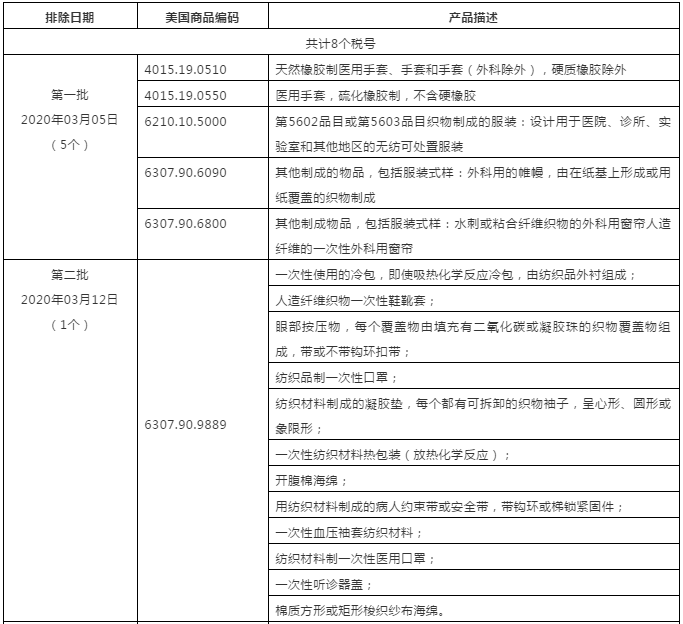

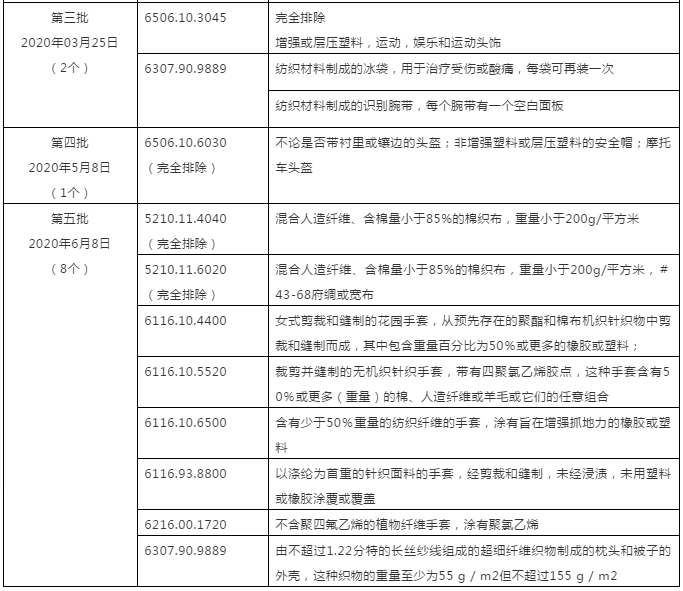

The descriptions and HS codes of the textile and apparel products excluded this time are as follows:

1)5210.11.4040 : Completely excluded, mixed man-made fibers, cotton fabrics containing less than 85% cotton, weight less than 200g/square meter;

2)5210.11.6020: Completely excluded , mixed man-made fiber, cotton fabric with less than 85% cotton content, weight less than 200g/square meter, #43-68 poplin or broadcloth;

3) 6116.10.4400: Women’s or girls’ garden gloves, cut and sewn from pre-existing woven knitted fabrics of polyester and cotton, containing 50% or more by weight of rubber or plastic;

4)6116.10.5520: Cut and sewn inorganic knitted gloves with tetrapolyvinyl chloride adhesive dots, which contain 50% or more ( 6116.10.6500: Gloves containing less than 50% by weight of textile fibers, coated Has rubber or plastic designed to enhance grip;

6)6116.93.8800: Gloves of knitted fabric, primarily polyester, cut and sewn, not Impregnated, not coated or covered with plastic or rubber;

7)6216.00.1720: Vegetable fiber gloves, not containing polytetrafluoroethylene, coated with polychloride Vinyl;

8)6307.90.9889: Pillow and quilt shells made of microfiber fabrics composed of filament yarns not exceeding 1.22 dtex, The weight of this fabric is at least 55g/m2 but not more than 155g/m2.

Summary table of textile and apparel product exclusions in the US$300 billion tax product exclusion list

The original address of the USTR announcement on the 300 billion exclusion list: https://ustr.gov/sites/default/files/enforcement/301Investigations/%24300_Billion_Exclusions_Granted_June.pdf

AAAGFHTRYKUYIU7OUP

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights, please contact us and we will change or delete it as soon as possible.

AA