The impact of TPP on Bangladesh’s garment manufacturing industry

On October 5, 2015, 12 countries including the United States, Japan, and Australia announced that they had reached an agreement on the Trans-Pacific Strategic Economic Partnership (TPP). Their combined economic aggregate accounts for 40% of the world’s total. Since all parties to the TPP agreed to exempt the textile and clothing industries from tariffs, and Vietnam, Bangladesh’s main competitor in the garment manufacturing industry, also participated, the news was announced and attracted widespread attention from the Bangladeshi government, businesses and academic circles. This article focuses on analyzing the impact of TPP on Bangladesh’s garment manufacturing industry and its implications for bilateral trade between China and Bangladesh.

1. Overview of Bangladesh’s garment manufacturing industry

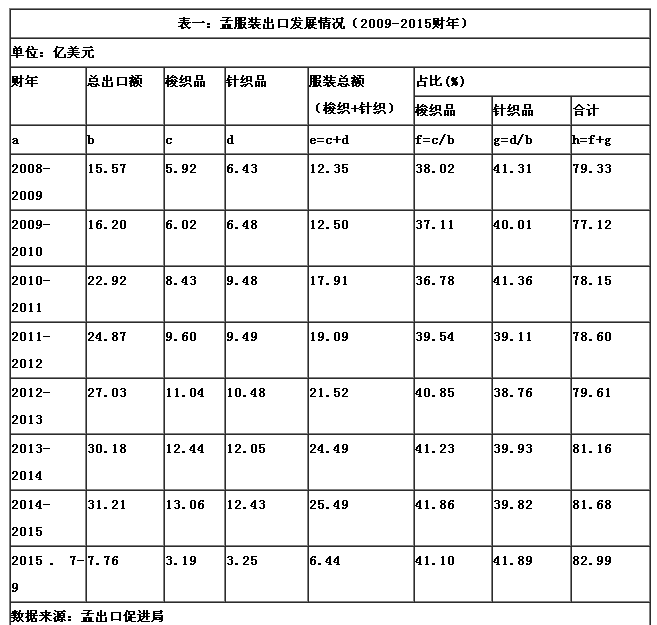

Bangladesh is a major apparel exporter after China. In 2014, Bangladesh’s apparel exports accounted for 5.1% of the total global apparel exports (China ranked first, accounting for 38.6%, and Vietnam ranked third, accounting for 4%). Garment manufacturing is also a pillar industry in Bangladesh. More than 80% of the country’s export revenue comes from this, and the proportion is increasing year by year (see Table 1).

Note: Fiscal year 2009 is from July 2008 to June 2009, the same below.

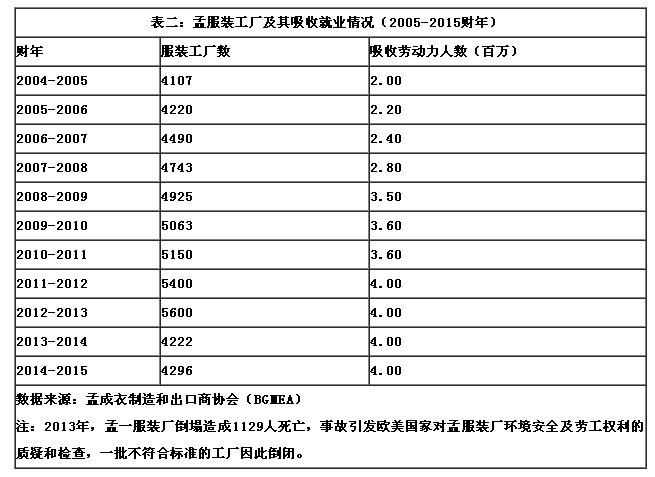

In addition to being an important source of national income, the garment manufacturing industry is a labor-intensive industry that plays an important role in promoting employment growth in Bangladesh, especially in solving the employment problem of women. According to statistics, there are currently 4,296 garment factories in Bangladesh, employing 4 million laborers, 85% of whom are women (see Table 2).

Data source: Bangladesh Garment Manufacturers and Exporters Association (BGMEA)

Note: In 2013, a garment factory collapsed in Meng, killing 1,129 people. The accident triggered questions and inspections in European and American countries about the environmental safety and labor rights of Bangladeshi garment factories, and a number of factories that did not meet standards closed down as a result.

The main destination countries for Bangladesh’s clothing exports are the United States and EU countries. In fiscal year 2015, Bangladesh’s clothing exports to the United States reached 5.288 billion, accounting for 21% of total clothing exports; followed by Germany, with exports of 434 million, accounting for 17%; the United Kingdom, France, and Spain accounted for 11% and 6% respectively. and 6% (see Table 3).

Data source: Bangladesh Export Promotion Bureau’s fiscal year 2015 data.

2. Analysis of the impact of TPP on Bangladesh’s garment manufacturing industry

Regarding the impact of TPP on Bangladesh’s garment manufacturing industry, there are two schools of thought in Bangladesh. One group believes that TPP will have a greater impact on Bangladesh’s garment industry and the government should respond appropriately; the other group believes that TPP will have little impact on Bangladesh. Don’t be too alarmed.

(1) Threat theory

Some enterprises and scholars in Bangladesh believe that Vietnam, the main competitor in Bangladesh’s garment industry, will use the TPP platform to further deprive Bangladesh of its export share. Specifically:

1. The tariff gap with the United States has further widened. The main destination for clothing exports from Bangladesh and Vietnam is the United States. Of the US$8.265 billion in clothing imports in 2014, Vietnam accounted for 918 million and Bangladesh accounted for 471 million (China accounted for 3.037 billion). Currently, the United States imposes an import tariff of 16.61% on Bangladeshi clothing and 8.38% on Vietnam; after the TPP takes effect, the tariff on Vietnam will be further reduced to zero. Although the Bangladeshi government has been trying to obtain 100% “double exemption” (tariff-free and quota-free) treatment from the United States to include clothing in the scope of duty-free, at present, the United States shows no signs of loosening up, and a series of vicious incidents occurred in Bangladesh in 2013 After the labor casualties incident, the United States has suspended the zero-tariff Generalized System of Preferences (GSP) for 97% of Bangladeshi products. After the TPP takes effect, Vietnam’s competitiveness in tariffs will be further enhanced.

2. Bangladesh’s LDC (least developed country) has lost its comparative advantage. For countries such as Japan, Australia, New Zealand, and Chile, Bangladesh currently enjoys zero-tariff treatment due to its LDC status. After the TPP takes effect, Vietnam will also enjoy zero-tariff treatment, thus weakening Bangladesh’s comparative advantage.

3. TPP will increase Vietnam’s investment attractiveness. It is expected to attract more foreign investment in Vietnam’s garment industry to enjoy preferential treatment; at the same time, in order to meet the requirements of rules of origin, it will help drive investment growth and expand production capacity in Vietnam’s spinning, weaving, printing and dyeing industries, further squeezing Bangladesh’s export share .

4. Potential risks of leaving the free trade agreement. Data show that Bangladesh’s per capita income in 2014 was US$1,080, which has reached the level of lower middle-income countries. It is expected to graduate from the LDC in 2021 and will lose all the preferential treatment it enjoys based on its LDC status. Bangladesh has not signed any bilateral free trade agreements so far. Apart from the loose South Asian Association for Regional Cooperation (SAARC) and the Asia-Pacific Trade Agreement (APTA), it has joined very few regional trade arrangements. Bangladesh should take a long-term view and join bilateral and regional trade agreements in a timely manner.

(2) Anti-threat theory

The Bangladeshi government and the garment industry association believe that the TPP will not have a major impact on Bangladeshi garment manufacturing and exports. The main reasons are as follows:

1. It will take some time for the TPP to come into effect. The TPP can only be implemented after approval by the legislative bodies of each member country, which is expected to take 1-2 years. Take the U.S. government, which is facing a change of government, as an example. The new round of candidates has many objections to the TPP, and there are still doubts whether it will ultimately be passed. As far as Vietnam is concerned, in order to meet the requirements of the TPP, a series of institutional changes are still needed, such as the realization of freedom of association. After Vietnam announces that it meets TPP requirements, the United States will also…��It will take two years to check whether Vietnam actually meets all requirements. If any discrepancies are found, the implementation of the US’s preferential treatment towards Vietnam will be delayed. Therefore, the Bangladeshi government has sufficient time to study countermeasures.

2. Among the 12 members of the TPP, Canada, Japan, Australia, New Zealand, Chile and other countries have implemented zero-tariff treatment for Bangladesh. Vietnam will not receive more preferential treatment than Bangladesh. Considering the restrictions of the TPP rules of origin, Bangladesh will not lose its market share in the above-mentioned regions.

3. TPP stipulates strict rules of origin. In addition to a few products such as baby clothing, women’s underwear, coats, suits, and skirts that follow the “cut and sew principle” (cut and sew), and Vietnam can immediately enjoy preferential export tax rates to TPP member countries, a large number of European and American products such as T-shirts, fleece sweaters, socks, and jeans are The clothing in demand must strictly comply with the yarn forward rule, that is, only if the product from yarn production to final assembly occurs in the country or a TPP member country, it will be regarded as a product of that country and enjoy preferential treatment. The raw and auxiliary materials of Vietnam’s garment industry mainly come from China, which is not a member of the TPP. Therefore, the scope of preferential treatment that Vietnam can enjoy is valid.

4. Meng’s clothing production cost advantage is significant. Bangladesh has a sufficient labor force, with 70% of the population under 40 years old, and 2 million new labor force members are added every year. The monthly minimum wage for ready-made garment workers is only 5,300 taka (approximately US$64.7), and the average wage is about half of that in Vietnam, even though Vietnam enjoys zero Tariff treatment may not have a cost advantage over Bangladesh.

3. Prospects of Bangladesh’s garment manufacturing industry and its implications for China-Bangladesh economic and trade relations

(1) Prospects of Bangladesh’s garment manufacturing industry

Although the Bangladeshi government denies that the TPP will have a major impact on its garment manufacturing industry, it also stated that it will take a series of measures to ensure its global competitiveness, including:

1. Expand the export market. On the one hand, it strengthens coordination with the United States and strives to make breakthroughs on issues such as the restoration of GSP and dual-free treatment; on the other hand, it opens up new markets and expands access to Japan, Australia, New Zealand, Canada and other countries that have implemented zero tariffs on Bangladesh in the TPP. countries, as well as exports from non-TPP countries such as the EU.

2. Expand production capacity, seize opportunities, and take over the market share of China’s manufacturing industry transfer and exit.

3. Reduce domestic business costs, such as providing tax exemptions, loan support, etc.

(2) Enlightenment on China-Bangladesh economic and trade relations

As a traditional major country in the textile and clothing industry, my country exported US$37.764 billion in textiles and US$76.610 billion in clothing to TPP member states in 2014, accounting for 31.70% and 40.79% of total textile exports and clothing exports respectively. Under the TPP’s zero tariffs and related rules of origin, my country also faces challenges. In this context, strengthening China-Bangladesh economic and trade cooperation is in the interest of both sides.

1. Strengthen production capacity cooperation with Bangladesh and use Bangladesh as an important docking place for the transfer of the garment industry. In view of the decline in labor cost advantages, some Chinese companies have successively set up factories in Southeast Asia, South Asia and other places. After the implementation of TPP, only if the entire industrial chain starting from spinning is transferred to TPP member states such as Vietnam can it enjoy preferential treatment. Bangladesh has obvious labor cost advantages and enjoys zero-tariff treatment for countries such as the EU. In order to continue after the implementation of TPP To ensure its global competitiveness, the Bangladesh government will further optimize the investment environment and protect the interests of investors, so that more domestic garment companies can enter the Bangladesh market and realize the transfer of production capacity. In recent years, our company has actively tried to build a textile and garment industrial park in Bangladesh. Our office will continue to promote it so that the project can be implemented as early as possible and achieve early results.

2. Promote bilateral free trade agreement negotiations in a timely manner. At present, due to its LDC status, most of Bangladesh’s products exported to China enjoy zero-tariff treatment, so Bangladesh is not very enthusiastic about negotiating bilateral free trade agreements. However, it is about to graduate from the LDC and will inevitably carry out free trade agreement negotiations. The TPP’s strict standards on a series of issues such as tax reduction, state-owned enterprises, environment, labor and product standards, agriculture, and intellectual property rights have resulted in Bangladesh not having the necessary qualifications. feasibility of joining. I can advance work on the free trade agreement with Bangladesh in due course and study trade rules acceptable to both parties.

AAA

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights and interests, please contact us and we will change or delete it as soon as possible.

AA