Indian Textile City Challenges Global Apparel Industry Overlord

The main disadvantage of the Indian textile industry is the low efficiency of workers, which is almost equivalent to one-third of Chinese workers

Indian clothing manufacturer T.R. Vijaya Kumar feels that India can challenge Bangladesh, Vietnam and even China in terms of its leading position in the global clothing industry.

Kumar, a second-generation garment maker, has built his family’s small vest-making business in southern India into a clothing export company with 1,700 employees and aims to double sales by 2020. . His hometown of Tirupur is known as the “Textile Capital of India”, and he has higher expectations for it: exports will triple and 500,000 new jobs will be created.

CBC fashion factory production line in Tirupur

“Tiruppur will be the next China.” Kumar said one evening in August 2016 at the office of CBC Fashions Pvt., where he runs, while showing reporters a demonstration of the products produced by him and other manufacturers. A hard-cover action plan launched. “China’s production costs have increased and they are phasing out the textile industry. Opportunities will come to other countries, so we have to seize it.”

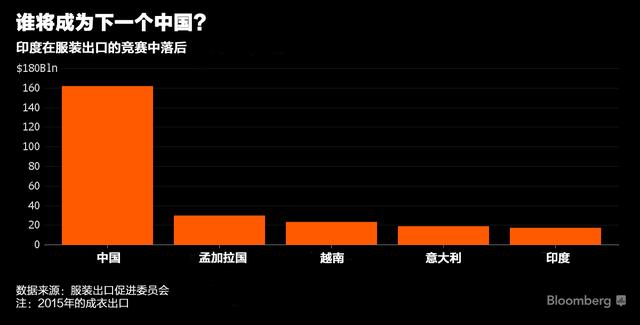

The problem is that other countries in Asia are already too far ahead. India’s $17 billion apparel exports are only half the size of Bangladesh’s in 2015, and its 3.7% global market share lags behind Vietnam’s 5.1%. Bridging these gaps is critical: the apparel industry is labor-intensive and has helped many developing countries transition from agricultural economies. The Indian economy needs to create 80 million new jobs by 2025 to meet the needs of its rapidly growing young population.

A recent poll shows that Indian Prime Minister Narendra Modi’s biggest failure so far is his failure to revive employment. In 2017, seven states in India will hold elections.

The Modi government recently announced a nearly US$1 billion stimulus package for the textile industry and apparel manufacturers, including recruitment subsidies, tax rebates and relaxed overtime regulations, with the goal of creating 10 million jobs in the next three years and enabling Exports increased by US$30 billion. ICRA Ltd., the local arm of Moody’s Investors Service, said the target was challenging given slowing demand in importing countries.

“The window of opportunity is narrowing and India must move quickly if it wants to regain competitiveness and market share in the textile industry,” said Arvind Subramanian, chief economic adviser to the Ministry of Finance and Textile Minister Rashmi Verma said in a June op-ed explaining the stimulus policy.

To make matters worse, the reputation of the Indian textile industry suffered a blow in August: Target Corp. terminated a $90 million cooperation with Welspun India Ltd. due to the company selling fake Egyptian cotton sheets.

Automated threats

The main disadvantage of the Indian textile industry is the low efficiency of workers, which is almost only 1/3 of Chinese workers. This is partly because India’s apparel production Traders are often unregistered and smaller than garment manufacturers in other countries, limiting their use of modern production technology and their ability to accept large orders.

Cutting workshop

This gap is likely to widen as foreign garment and textile manufacturers deepen automation. “India must seize the opportunity to take advantage of its young population,” said Russell Green, an international economics fellow at Rice University’s Baker Institute for Public Policy. “Automation will make the time available to India shorter and shorter.”

About 78% of Indian companies have fewer than 50 employees, compared with 15% in China, Subramanian said. It also means many businesses remain outside the threshold of government taxation and regulation, in what economists call the “informal” economy. A report released by the World Bank in 2016 showed that the number of formal garment workers in Bangladesh is 15 times that of informal workers, while the number of informal garment workers in India is seven times that of formal workers.

Venkatachalam Babu (Venkatachalam Babu) is the owner of a small business. He calculates wages for workers on a piece-by-piece basis. In a workshop attached to his residence, his 12 employees, including two relatives, cut and sew children’s underwear and trousers from leftover fabric he buys from exporters.

Venkatacharam Babu

Although foreign markets are out of reach, Babu can still rely on a rapidly expanding domestic market, an advantage that smaller competitors do not have. He himself used to work for others and started his own company 20 years ago with four workers. He said that when there are more than 20 employees, he will register them.

“We want to be big,” he said, as his mother sat cross-legged on the floor, sorting clothes, surrounded by bags of fabric. “Labour shortage is a problem.”

Off-season

This may sound incredible for a country with a population of 1.2 billion, but all four manufacturers interviewed by Bloomberg in Tirupur reported the same problem as Babu. Tirupur district has a population of 2.5 million, and housing construction here has failed to meet the needs of the expanding migrant population. Kumar’s action plan calls the lack of skilled labor “the biggest threat to the growth of the textile industry” and recommends building houses and dormitories for 300,000 people.

Workers folding cotton cloth

India also faces other constraints. India’s ability to enter the winter apparel market is limited as it only produces pure cotton apparel, while buyers also view India as less efficient and less reliable than China or Vietnam. In neighboring Bangladesh, the garment industry accounts for 80% of overseas exports. The monthly minimum wage is about 30% lower than India’s US$105. In addition, Bangladeshi exporters do not need to pay tariffs to EU countries.

Although India has large-scale cotton production, “it is difficult for Indian companies to compete in the face of Bangladesh’s preferential tax treatment.” Anil Gupta, an analyst at ICRA, said. He said the industry “lives on government incentives” that help businesses stay profitable and keep hiring.

The Indian government said on August 31 that in the three months to June, overall exports of goods increased by 3.2%, showing signs of rebound after five consecutive quarters of contraction.

Still, India is not as supportive of garment manufacturers as Bangladesh is, said M. Arul Saravanan, chief marketing officer of Tirupur-based SCM Garments Pvt. . The company has 15,000 employees and counts French sports retailer giant Decathlon SA as one of its customers. He said signing a trade agreement and stabilizing cotton prices would greatly stimulate investment.

T·R·Vijaya Kumar

Exporters in Tirupur have also banded together to reduce costs, teach other companies about “lean” production management techniques, and train factory workers to increase output. The government partially funds these projects.

Kumar said the move was prompted by Modi, who during the 2013 election campaign called on manufacturers to propose expansion rather than just citing concerns. Now they hope to take the action plan to the capital, 2,400 kilometers away, so that Modi can mobilize all ministers to take action.

“To compete, we have to cultivate new startups in India and we have to reduce operating costs.” Kumar said. “That’s why we asked the Prime Minister to hold a meeting in Delhi – just like the industrial cluster in Tirupur, we must let more industrial clusters emerge in India.” Indian Textile City Challenges Global Apparel Industry Overlord

AAA

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights and interests, please contact us and we will change or delete it as soon as possible.

AA